Good day,

AI, cryptocurrency, and technological developments—on the International Fintech Fest (GFF) 2025, the highlight was on the way forward for finance.

This 12 months’s focus, particularly, was on how AI can form the way forward for digital funds, credit score, compliance, danger administration, and extra.

Paytm founder Vijay Shekhar Sharma believes pace is of the essence to shore up India’s technological sovereignty, urging motion to develop home AI capabilities.

In the meantime, PhonePe’s Sameer Nigam and Razorpay’s Shashank Kumar selected to stress the necessity for a dependable funds infrastructure and the way suppliers might adapt to maintain up with the dimensions.

Learn our protection from GFF 2025 right here.

Moreover, the federal government can also be set to roll out biometric authentication for funds made by the Unified Funds Interface beginning October 8, utilizing knowledge saved underneath Aadhaar.

In different information, the markets proved their enthusiasm for brand spanking new choices remains to be as sturdy as ever, as LG Electronics Inc.’s $1.3 billion preliminary share sale of its Indian unit was totally subscribed on the primary day.

WeWork India Administration’s $338 million IPO was additionally totally subscribed on the ultimate day of bidding, pushed by institutional demand.

In truth, October’s anticipated to be a bumper month for fairness listings, with proceeds anticipated to cross a whopping $5 billion.

Lastly, meet the winners of the 2025 Nobel Prize in Physics, whose experiments are paving the way in which for the subsequent era of quantum expertise!

In as we speak’s publication, we are going to discuss

GIFT Metropolis will get a brand new systemA new path to wealth creationBuilding India’s monetary capital anew

Right here’s your trivia for as we speak: Which 1996 one-hit marvel by Los Del Rio grew to become a worldwide dance craze?

Fintech

GIFT Metropolis will get a brand new system

Finance Minister Nirmala Sitharaman on Tuesday launched the overseas forex settlement system at GFF 2025 in Mumbai—a key milestone for GIFT Metropolis’s Worldwide Monetary Providers Centre.

This transfer is anticipated to boost liquidity administration and operational resilience. It is going to additionally strengthen India’s place amongst key monetary hubs equivalent to Hong Kong and Tokyo, nations that have already got such settlement methods.

Key takeaways:

The system will allow real-time or near-real-time settlement of overseas forex transactions inside IFSC. Presently, funds are delayed by 36 to 48 hours as they’re routed by a number of correspondent banks and nostro banks.Highlighting India’s evolving fintech panorama, Sitharaman mentioned the federal government’s function is to “allow, not interrupt” companies. She pressured that expertise should stay a software for the general public good.The minister additionally famous that fintech companies are the long run architects of finance, emphasising 4 guiding messages—concentrate on fundamentals and compliance, steadiness pace and scale with security, view regulation as a “seat belt” for protected accelerations, and assist shut gaps on the subject of monetary inclusion.

Funding Alert

Startup: Intangles

Quantity: $30M

Spherical: Sequence B

Startup: The Medical Journey Firm

Quantity: $4.5M

Spherical: Seed

Startup: Contrails AI

Quantity: $1M

Spherical: Pre-Seed

Fintech

A brand new path to wealth creation

At a time when India’s capital markets are increasing sooner than ever, trade leaders and regulators agree on one factor: expertise—not simply coverage—will decide how inclusive this development turns into.

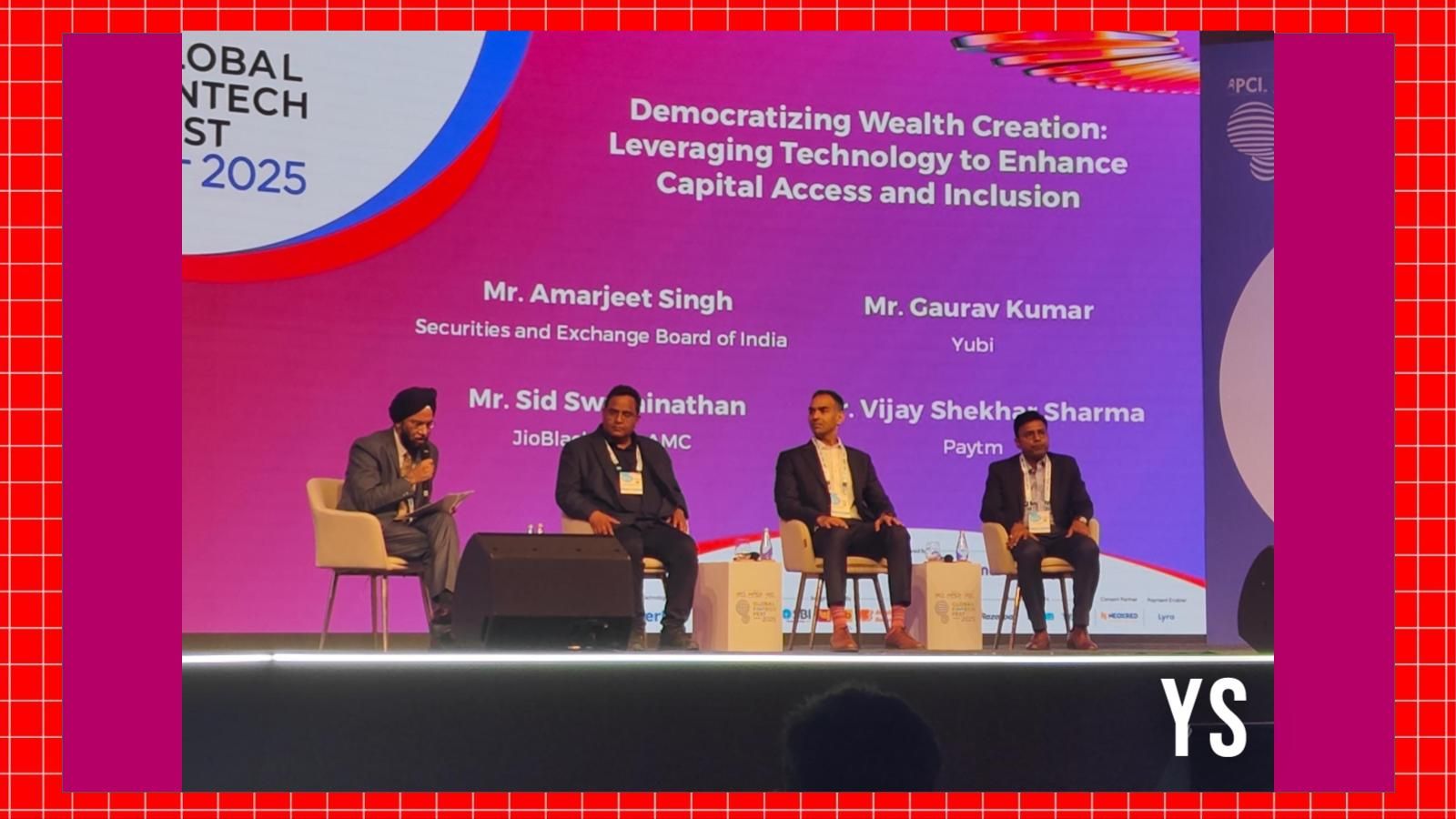

The GFF 2025 in Mumbai introduced collectively among the nation’s most influential voices from finance and expertise, and their message was clear: India’s markets are maturing, however widening participation will rely upon constructing belief, bettering transparency, and utilizing expertise to decrease long-standing entry limitations.

Ideas:

Paytm CEO Vijay Shekhar Sharma mentioned, “The at first rule of thumb for a private-market firm to go public is that the regulator should be welcoming and alluring,” recalling how SEBI’s determination to permit loss-making companies to record in 2021 made India “essentially the most vibrant market to lift capital.”Gaurav Kumar, Founder and CEO of Yubi, mentioned the time had come to view India’s non-public and public markets as a part of a single ecosystem reasonably than two separate worlds.For Sid Swaminathan of JioBlackRock AMC, the subsequent frontier of democratisation lies with extraordinary traders. He mentioned monetary inclusion would deepen solely when data turns into simpler to grasp and act upon.

Fintech

Constructing India’s monetary capital anew

Think about a Mumbai the place monetary grit meets a layer of machine intelligence, making the town greater than only a hub of merchants. That’s how Vishal Dhupar, MD, NVIDIA South Asia, envisions Mumbai 5 years from now.

“In 2028, we might be calling Mumbai the finance capital with intelligence, reasonably than simply the finance capital. I’m fairly sure about it…,” mentioned Dhupar, talking throughout a fireplace chat on the sixth GFF in Mumbai.

Information & updates

Outlook: The World Commerce Organisation on Tuesday hiked its forecast for international commerce development in 2025 however warned that the outlook for 2026 had deteriorated. The WTO predicted that commerce quantity development in 2025 would rise to 2.4%, whereas it slashed its earlier expectation for 2026 commerce quantity development to a lacklustre 0.5%.Make investments: New York Inventory Trade proprietor Intercontinental Trade mentioned it might make investments as much as $2 billion in Polymarket in a deal that values the favored crypto-based prediction market at roughly $8 billion, providing an enormous vote of confidence within the platform’s development prospects.Sturdy demand: Dell practically doubled its annual revenue development goal for the subsequent 4 years, betting on sturdy demand for its servers that energy synthetic intelligence workloads. The corporate lifted its expectations for annual development in adjusted earnings per share to no less than 15% from round 8%.

Which 1996 one-hit marvel by Los Del Rio grew to become a worldwide dance craze?

Reply: Macarena.

We might love to listen to from you! To tell us what you appreciated and disliked about our publication, please mail nslfeedback@yourstory.com.

Should you don’t already get this text in your inbox, join right here. For previous editions of the YourStory Buzz, you may test our Each day Capsule web page right here.