Issues are altering quick in monetary providers, from the rise of crypto to the expansion of the fintech app class to the event of robo-advisors. As monetary providers turns into a extra digital {industry}, social media advertising is changing into a extra crucial technique of promotion within the house.

Even when your group leans extra conventional, social media is a mandatory channel to succeed in youthful shoppers. And you could be ready for what’s coming. Gartner discovered 75% of monetary providers leaders anticipate vital modifications within the {industry} by 2026.

Right here’s why (and the way) to construct a monetary providers social media technique this yr.

#1 Social Media Software for Monetary Providers

Develop your shopper base with the device that makes it straightforward to promote, have interaction, measure, and win — all whereas staying compliant.

Guide a Demo

1. Attain new audiences

Social media is the place Gen Z goes searching for monetary info. The oldest members of this age group are turning 25 this yr. And so they’re beginning to hit main milestones that deserve monetary recommendation. 70% of them are already saving for retirement.

Practically 1 / 4 of 16-to-24-year-olds already use a monetary providers web site or app each month. Ten p.c of them already personal some type of cryptocurrency.

Even in the event you’re not advertising to Gen Z, social media is a crucial channel for connecting with new shoppers. Greater than three-quarters (75.4%) of web customers use social media for model analysis.

2. Strengthen relationships

Constructing relationships is a key use of social media for finance {industry} professionals. In relation to cash, everybody desires to cope with somebody they know and belief.

Nurturing prospects and shoppers on-line is called social promoting. Right here’s a fast primer on the way it works:

Social media can assist establish vital monetary moments in shoppers’ and prospects’ lives. For instance, LinkedIn is a good place to find out about profession modifications or retirements. Following shoppers’ enterprise pages also can provide you with perception into their challenges.

That stated, social promoting is often about constructing relationships. Gross sales are a longer-term aim.

When a connection will get a brand new job or launches a brand new enterprise, by all means, ship a congratulations message. (Practically 95% of advisors who use social media successfully use some type of direct messaging.)

Maintain your self prime of thoughts. However don’t leap in and attempt to make a sale.

It’s vital to concentrate on offering reliable info and assets. Practically 1 / 4 of Web customers observe a model they’re contemplating buying from on social networks. They need to observe and observe for some time earlier than leaping in.

Give attention to the shopper’s wants slightly than making the sale.

3. Spotlight model objective and construct group belief

Monetary providers manufacturers now have to point out they’re about greater than monetary returns.

64% of respondents to the 2022 Edelman Belief Barometer survey stated they make investments based mostly on beliefs and values. And 88% of institutional traders “topic ESG to the identical scrutiny as operational and monetary issues.”

Youthful traders are significantly inquisitive about sustainable investing. A Harris Ballot for CNBC confirmed {that a} third of millennials, 19% of Gen Z, and 16% of Gen X “typically or solely use investments centered on ESG (environmental, social, and governance) elements.”

And a Natixis report discovered that 63% of millennials consider they’ve a accountability to make use of their investing to assist resolve social points.

Belief within the monetary providers sector has grown during the last 10 years. However it’s nonetheless one of many least trusted industries in response to the Edelman Belief Barometer. Social media lets you construct belief and deal with shopper issues.

Supply: 2024 Edelman Belief Barometer

4. Humanize your model

Folks need to cope with trusted monetary specialists. That doesn’t imply they need their monetary providers suppliers to be medical and chilly. Social media offers an important alternative so that you can humanize your model.

Getting your organization’s executives on social media is usually a good spot to begin. In any case, it may be simpler to belief an individual slightly than an establishment.

Potential shoppers anticipate to see your C-suite executives on social. 86% of monetary publication readers say it’s vital for enterprise leaders to make use of social media. They belief leaders who use social media greater than those that don’t by a ratio of 6 to 1.

After all, the tone you are taking will depend upon the community you’re utilizing and the audience you’re making an attempt to succeed in. The common advisor makes use of 4 social networks, with essentially the most profitable utilizing 6.

5. Achieve key {industry} and buyer insights

Attempt utilizing social media for monetary providers {industry} analysis. This can be a good strategy to keep on prime of what’s occurring in your subject.

Does a competitor have a brand new product providing? Is there an impending PR catastrophe? Consider social media as an early warning system.

Social media listening can inform you what’s occurring within the {industry}. Right here’s the way it works:

You may as well use social listening to find out about your potential prospects and gauge what they need from you.

Additionally, make sure you regulate your social media analytics. These instruments provide you with insights into the effectiveness of your individual social efforts. You possibly can study what works greatest. Then, refine your social media advertising technique for monetary service prospects as you go.

6. Cut back effort and prices

Social efforts work greatest when groups, departments, and particular person advisors use social media in a coordinated approach. Almost definitely, this entails a shared social media administration platform.

A content material library is a useful useful resource for each staff and types. Workers has entry to pre-approved, compliant content material that’s able to go. Manufacturers have peace of thoughts when staff submit constant messaging that helps strategic targets.

When every little thing is housed in a single central library, there’s no duplication of effort or expense. This pre-approved library addresses monetary advisors’ prime two issues about utilizing social media:

Lack of time

Worry of constructing a mistake.

7. Present unified digital customer support

Because the monetary {industry} turns into more and more digital, customer support must observe swimsuit. Clients need to attain out to companies on the platforms the place they already spend their time. Which may imply social networks like Fb or social messaging apps like WhatsApp.

Social customer support instruments will let you coordinate your customer support throughout all channels. On the similar time, you’ll be able to hyperlink conversations to your CRM. This helps make sure you meet compliance necessities for response time in addition to record-keeping.

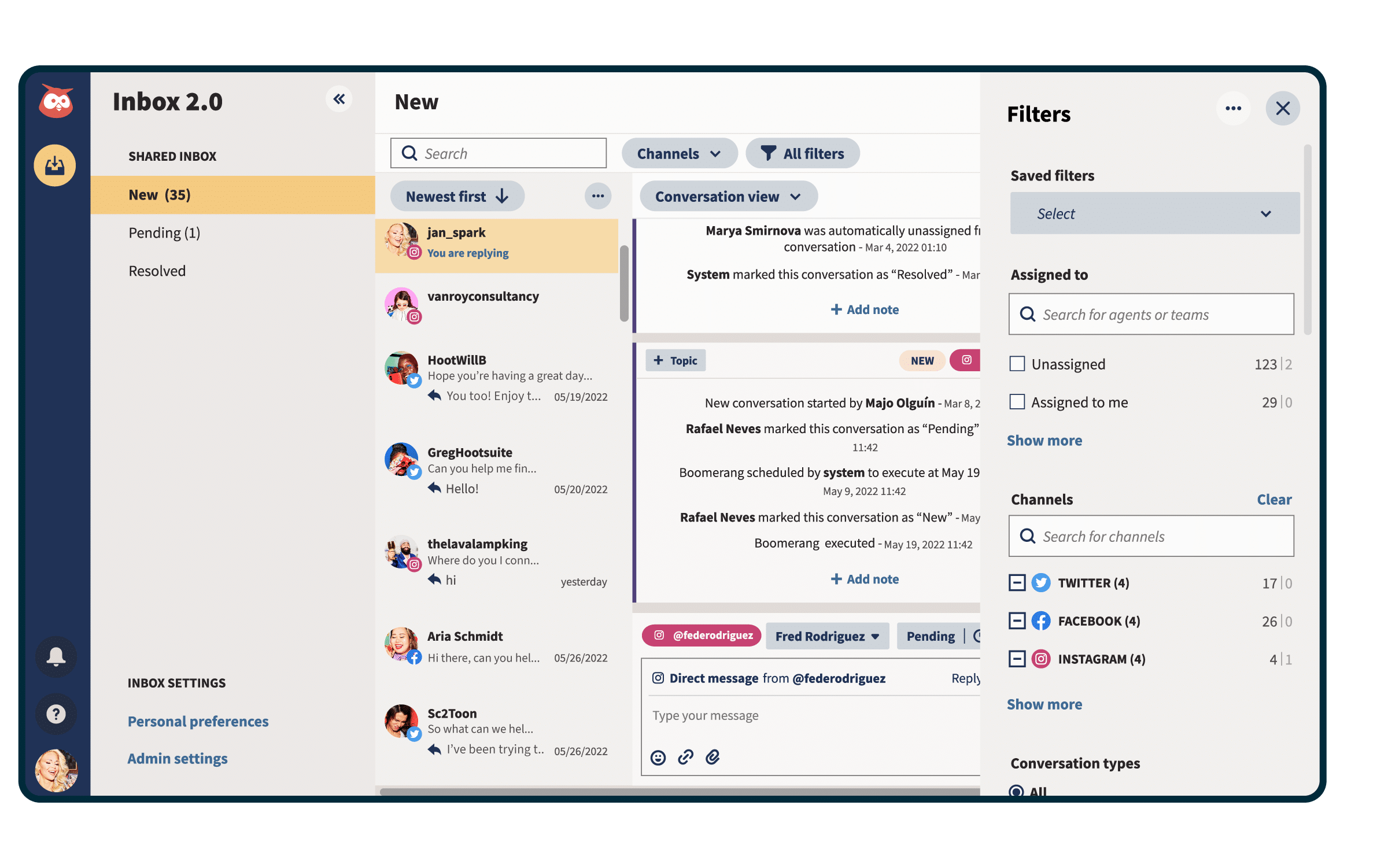

With Hootsuite Inbox, you’ll be able to bridge the hole between social media engagement and customer support — and handle your whole social media messages in a single place. This contains:

Non-public messages and DMs

Public messages and posts in your profiles

Darkish and natural feedback

Mentions

Emoji reactions

… and extra.

The all-in-one agent workspace makes it straightforward to

Observe the historical past of any particular person’s interactions together with your group on social media (throughout your accounts and platforms), giving your workforce the context wanted to personalize replies

Add notes to prospects’ profiles (Inbox integrates with Salesforce and Microsoft Dynamics)

Deal with messages as a workforce, with intuitive message queues, process assignments, statuses, and filters

Observe response occasions and CSAT metrics

Plus, Inbox comes with helpful automations:

Automated message routing

Auto-responses and saved replies

Robotically triggered buyer satisfaction surveys

AI-powered chatbot options

8. See actual enterprise outcomes

Put merely, social media impacts your backside line in concrete, measurable methods.

81% of monetary advisors who use social media say they’ve gained new enterprise property by their social efforts. In truth, advisors utilizing social media efficiently report a mean of $1.9 million in property gained by social media actions.

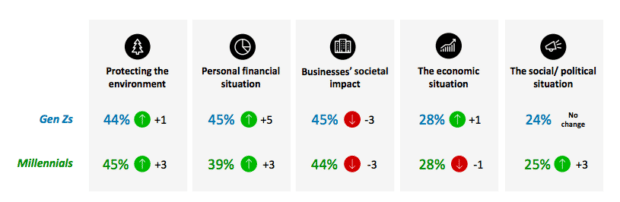

Deloitte’s World 2022 Gen Z and Millennial Survey discovered that younger individuals’s optimism about their very own monetary conditions is bettering. Nonetheless, each of those generations are total nonetheless anxious about their monetary safety.

Supply: Temper Monitor Drivers, Deloitte World 2022 Gen Z and Millennial Survey

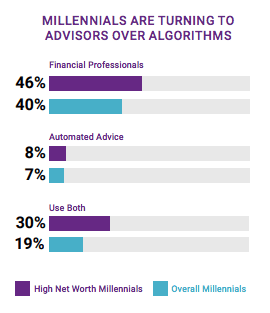

On the similar time, the Natixis World Survey of Particular person Buyers discovered that 40% of millennials—and 46% of high-net-worth millennials—need private monetary recommendation from a monetary advisor. Social media is an ideal place to attach with these new shoppers.

Supply: Natixis World Survey of Particular person Buyers: 5 Monetary Truths About Millennials at 40

1. Give attention to compliance

FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, GDPR—all of the compliance necessities could make your head spin.

It’s crucial to have compliance processes and instruments in place, particularly to information unbiased advisors’ use of social media.

Get your compliance workforce concerned as you develop your monetary providers social media technique. They’ll have vital steerage on the steps you could take to guard your model.

It’s additionally vital to have the appropriate chain of approvals in place for all social media posts. For instance, FINRA states:

“A registered principal should evaluate prior to make use of any social media website that an related particular person intends to make use of for enterprise.”

2. Archive every little thing

This falls underneath compliance, but it surely’s vital sufficient that it’s price calling out by itself.

Based on FINRA: “Corporations and their registered representatives should retain data of communications associated to their “’enterprise as such.’”

These data have to be stored for at the least three years.

Hootsuite’s integrations with compliance options like Brolly and Smarsh mechanically archive all social media communications. You’ll have your social content material saved in a safe and searchable database, full with the unique context.

3. Conduct a social media audit

In a social media audit, you doc all of your firm’s social channels in a single place. You additionally word any key info related to every. On the similar time, you’ll seek out any impostor or unofficial accounts so you’ll be able to have these shut down.

Begin by itemizing all of the accounts your inner workforce makes use of commonly. However bear in mind—that is simply a place to begin. You’ll must search for outdated or deserted accounts and department-specific accounts.

When you’re at it, make word of the social platforms the place you don’t have any social accounts. It is likely to be time to register profiles there. (TikTok, anybody?) Even in the event you’re not prepared to make use of these instruments but, you may need to reserve your model handles for future use.

We created a free social media audit template to assist hold all of your analysis organized as you deal with this work.

4. Implement a social media coverage

A social media coverage guides social media use inside your group. That features accounts on your advisors and brokers.

Attain out to all of the related groups inside your group, together with:

Compliance

Authorized

IT

Info safety

Human assets

Public relations

Advertising

All these groups ought to have enter. This can make it easier to keep a constant model id whereas decreasing compliance challenges.

Your coverage can even outline workforce roles and approval buildings so everybody understands the workflow of a social submit. This readability upfront can assist cut back frustrations that social media won’t transfer as shortly as some would really like.

Utilizing social media for finance {industry} functions also can include safety dangers. Embody a piece in your social media coverage that outlines safety protocols for the less-sexy elements of social media. For instance, prescribe how typically to alter passwords and the way typically software program ought to be up to date.

Bonus: Obtain a free bundle of social media instruments designed particularly for monetary providers — together with submit concepts and templates for social media insurance policies, methods, and reviews.

How typically do you have to submit on social media in monetary providers?

Each monetary establishment’s splendid posting schedule is exclusive, and it is best to take a look at completely different posting frequencies to seek out out what works greatest on your viewers. That stated, these industry-specific stats will make it easier to discover a data-informed start line.

Our analysis discovered that monetary establishments submit on Instagram extra typically than on different social platforms — a mean of two.9 occasions per week. Fb and LinkedIn observe, with a mean frequency of two.8 and a pair of.7 posts per week.

Common engagement charges in monetary providers

Questioning in case your engagement charges are excessive sufficient? Listed here are the {industry} averages throughout all main social networks as of December 2024:

LinkedIn: 2.3%

Instagram: 1.8%

Instagram Reels: 1%

Fb: 1.2%

X (Twitter): 1.1%

Follower development fee in monetary providers

In case your social media technique revolves round rising your viewers, ensure you’re setting life like targets. Right here is how different FinServ profiles are doing in This fall 2024:

Instagram: 2.8%

LinkedIn: 0.54%

X (Twitter): 0.24%

Fb: -0.01%

For extra FinServ-specific analysis, together with the most effective occasions to submit, essentially the most partaking content material codecs, and network-specific breakdowns of the stats above, try our devoted submit on social media benchmarks for monetary providers.

1. Present x MrBeast

Present is a monetary providers firm that primarily presents cellular banking providers by an app. To construct model consciousness, they partnered with high-profile influencers together with Hailey Bieber and Logan Paul.

I provided a navy squad $100,000 if they might efficiently hunt me down in a day, GO WATCH THE NEW VIDEO!

— MrBeast (@MrBeast) December 10, 2021

Particularly, they developed an ongoing collaboration with the influencer MrBeast. Two of the ensuing social movies reached the number one prime trending video spot on YouTube. On account of the marketing campaign, Present noticed a 700% enhance in cash requests by the app and have become the quantity 5 finance app within the Apple App Retailer.

2. BNY Mellon #DoWellBetter

BNY Mellon developed a marketing campaign to spotlight the optimistic impacts of their high-net-worth shoppers. That includes lovely portraits and video interviews, the marketing campaign confirmed how sound investing and wealth administration by BNY Mellon allowed them to construct the assets to impact optimistic change.

Telling shopper tales is an effective approach for monetary establishments to create a human connection on social media platforms.

3. Vanguard Group #GettingSocial

Funding firm Vanguard Group makes use of a weekly sequence of social movies to share experience on investing and different monetary subjects.

Releasing the movies on a constant schedule trains followers to anticipate the content material. This encourages viewers to verify again weekly and turn out to be common watchers over time. The movies provide brief, snackable insights. They don’t require a big time dedication from busy followers.

In addition they run social adverts that talk to comparable subjects. This exposes social customers to instructional and conversion-oriented content material that work in live performance.

Hootsuite makes social advertising straightforward for monetary service professionals. From a single dashboard, you’ll be able to handle all of your networks, drive income, present customer support, mitigate danger, and keep compliant.