New options and enhancements within the newest model of ProjectionLab.

This can be a massive one! Our newest replace is filled with new options and enhancements that will help you construct much more versatile, correct, and lifelike monetary plans.

From smarter tax modeling and inheritance instruments to month-to-month occasion timing and extra intuitive plan alignment, this launch brings in lots of concepts and suggestions we’ve heard instantly from all of you. We hope you get pleasure from it!

Right here’s a more in-depth have a look at what’s new.

Added Help for Inherited IRAs

Inherited IRAs can now be totally modeled in your plans. Now you can:

Mannequin each Conventional and Roth Inherited IRAsChoose between 10 yr withdrawal home windows, stretch RMDs, or a customized distribution schedule

When you’ve got already obtained, or anticipate to obtain, an inherited IRA, you may see precisely the way it matches into your broader plan and optimize your withdrawal technique and taxes.

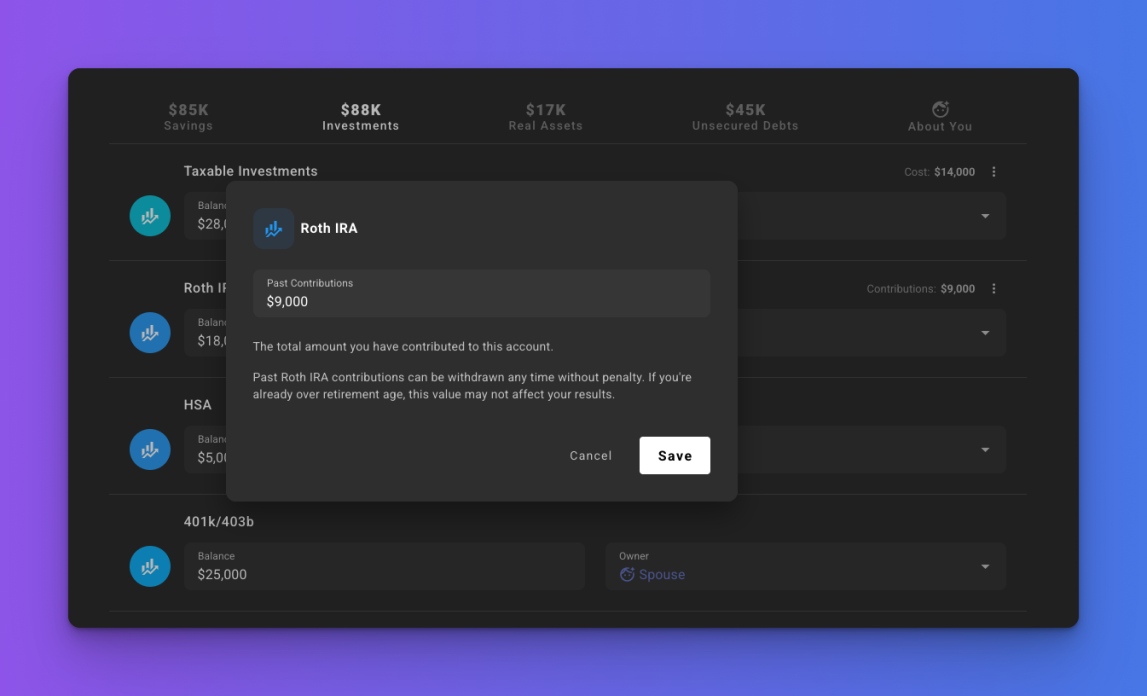

Simpler Monitoring of Value Foundation and Contributions

Value foundation and previous contributions at the moment are entered as greenback quantities in Present Funds, as a substitute of as percentages inside every account.

This makes it extra intuitive and simpler to maintain your plans correct and updated. When you’ve got a number of plans related to Present Funds, you solely must replace this info in a single place. No extra adjusting every plan manually when contributions change.

Extra Correct State and Native Tax Modeling

It’s now a lot simpler to mannequin the impression of state and native taxes in your plan. You will get a clearer image of how these taxes have an effect on your projections, particularly in case you reside in a state or metropolis with distinctive tax guidelines.

This replace makes it simpler to:

If you happen to beforehand constructed workarounds for issues like NYC native tax, California State Incapacity Insurance coverage (SDI), or state tax guidelines round retirement earnings, now you can simplify your plan and belief that these eventualities are being modeled accurately.

Extra Exact Timing for Revenue, Bills, and Occasions

Now you can outline month-to-month begin and finish dates for earnings streams, bills, and milestones. Occasions shall be prorated routinely, so your plan can extra precisely replicate adjustments that occur mid-year.

For instance, you may:

Mannequin an element time job, consulting undertaking, or sabbaticalPlan for short-term bills corresponding to childcare, tuition, or travelReflect the true timing of life occasions in your money move projections

This offers you extra flexibility to construct plans that match how your monetary life really unfolds.

Calendar 12 months Alignment

Plans now align to the calendar yr by default. We heard from lots of you that rolling years had been complicated and never the way you usually take into consideration years, so we hope this modification makes issues really feel rather more intuitive.

It additionally improves first yr accuracy, particularly for partial yr occasions and steady earnings streams. In case your plan begins in the course of a yr, the impacts of occasions shall be prorated accordingly. If you happen to beforehand used a set date plan to attain calendar yr alignment, now you can change again to a regular plan for a smoother expertise.

For UK and Australian customers, there are additionally built-in choices to align plans to your native tax yr.

Discover what’s new

That covers a few of the highlights in v4.3.0, however there’s extra beneath the hood as nicely.

If you need a fast walkthrough, we put collectively a brief video:

You may as well try the complete launch notes right here.

Whether or not you’re updating an present plan or constructing one thing new, we hope these enhancements make it simpler to mannequin your monetary life and discover new prospects.

![Is ChatGPT Catching Google on Search Exercise? [Infographic] Is ChatGPT Catching Google on Search Exercise? [Infographic]](https://i0.wp.com/imgproxy.divecdn.com/RMnjJQs1A7VQFmqv9plBlcUp_5Xhm4P_hzsniPsfHiU/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9kYWlseV9zZWFyY2hlc19pbmZvZ3JhcGhpYzIucG5n.webp?w=75&resize=75,75&ssl=1)