Buyers are beginning to really feel a wholesome dose of cognitive dissonance—that grating feeling when two beliefs you maintain do not fairly line up.

On one hand, the U.S. market is hovering on the again of AI optimism and potential tax cuts.

And on the opposite, corporations’ inventory costs, relative to their precise earnings, are beginning to loosely resemble the run-up to the Dotcom bubble of the late 90s.

So which perception will win out in 2025: growth or bust? Let’s parse this conflicted outlook by analyzing three questions specifically:

Are U.S. shares overvalued?

Round this time final 12 months, we mentioned the booming market on the time would possibly hold going if the Fed lowered rates of interest in response to cooling inflation.

Rates of interest did tick down, and boy, did markets take discover. Via the tip of November 2024, a 90% inventory Betterment Core portfolio returned roughly 17.6% year-to-date.

Such a run, nevertheless, begs hypothesis of yet one more reversal, a swing of the pendulum towards much less frothy valuations and a downside in portfolio returns. The S&P 500 at present prices about 25 instances greater than what these corporations are anticipated to herald over the subsequent 12 months. For comparability, this common “price-to-earnings” ratio over the past 35 years has been 18x.

Taking the attitude of a long-term investor, nevertheless, these ratios matter lower than chances are you’ll assume. As long as you keep invested for various years, likelihood is the market as an entire could “develop” into its valuation.

Keep in mind 2021 when a bunch of tech-centric, dangerous shares have been darlings of the pandemic and shot to the moon? Analysts rightly known as foul—these sorts of valuations shouldn’t be sustainable.

However inside just a few years the market was setting contemporary all-time highs. An investor who had bought or stayed on the sidelines would’ve missed out on all that development. So in case you’re tempted to promote “excessive” proper now, keep in mind this:

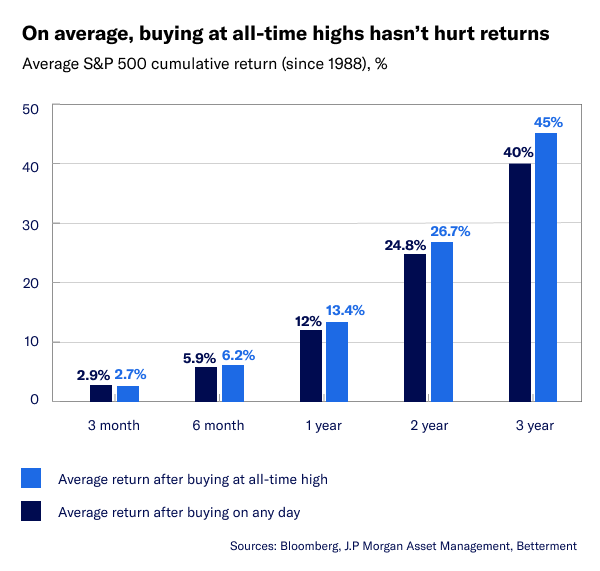

On common, investing at all-time highs hasn’t resulted in decrease future returns in comparison with investing on any given buying and selling day.

Quite the opposite, shopping for when the market has by no means been larger results in barely larger common returns in the long term. You possibly can by no means make sure precisely when a development cycle will finish.

Will AI pan out?

A giant driver of this bull market has been optimism surrounding synthetic intelligence and the massive tech corporations powering it, like Amazon, Google, and the pc chip-maker Nvidia. They’ve rallied big-time over the past 12 months, and in consequence, they make up an more and more massive share of the U.S. and world inventory market.

A debate, nevertheless, surrounds their outperformance and the hoopla round AI basically. Some analysts argue {that a} good quantity of AI funding received’t in the end show fruitful, whereas others foresee important boosts to productiveness and earnings.

There’s that grating feeling once more—the potential of revolutionary upside sitting proper subsequent to worries that it’s largely hype. Within the face of uncertainty, all one can do to decrease their danger is hedge their bets and diversify. Our portfolios’ inventory allocations take this to coronary heart, providing important publicity to Huge Tech, whereas additionally investing in European, Japanese, and rising markets. It’s these inexpensive equities that present a possible buffer within the occasion AI’s ambitions fall quick.

There’s that grating feeling once more—the potential of revolutionary upside sitting proper subsequent to worries that it’s largely hype. Within the face of uncertainty, all one can do to decrease their danger is hedge their bets and diversify. Our portfolios’ inventory allocations take this to coronary heart, providing important publicity to Huge Tech, whereas additionally investing in European, Japanese, and rising markets. It’s these inexpensive equities that present a possible buffer within the occasion AI’s ambitions fall quick.

Do markets care who’s within the White Home?

Proper now, markets aren’t positive precisely what to make of President-elect Trump’s proposed financial agenda. Guarantees of company tax cuts, whereas fueling the current surge in shares, may in follow improve inflation. Similar goes for tariffs and mass deportation. And rising inflation may in flip pause or reverse the current development in rate of interest cuts. However till extra particulars emerge, or the insurance policies themselves are literally put into follow, we received’t know their full impact.

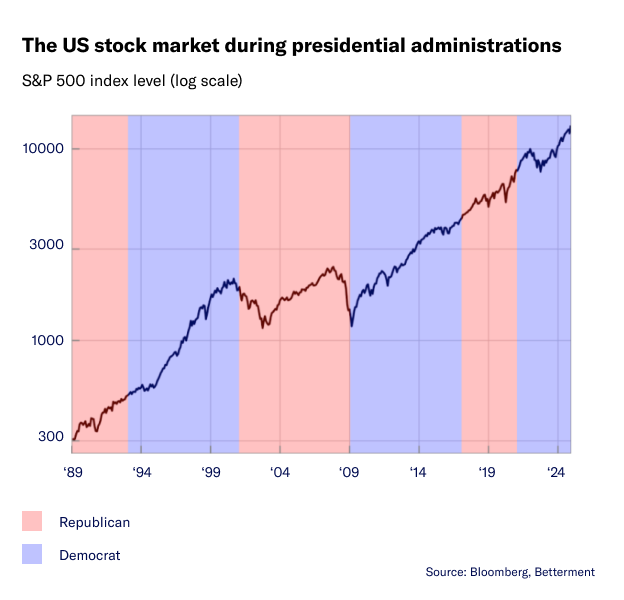

As a substitute of sitting again and anxiously ready, we advise having a look on the chart beneath. It reveals that markets are likely to rise over time no matter which celebration holds the presidency. Sustaining a constant, diversified funding strategy is one of the best ways to navigate political and financial cycles. That, and possibly cooling it a bit in your information consumption.

So what now?

As at all times, it’s inconceivable to know precisely how lengthy every development cycle will final, so think about erring on the facet of staying invested. If you end up sitting on an excessive amount of money, now may be the time to place it to work available in the market. You possibly can make investments it as a lump sum, which analysis reveals could supply larger potential returns. Or you’ll be able to sprinkle it right into a portfolio over time. Most significantly, nevertheless the market performs in 2025, we advise zooming out and reminding your self you’re in it for the lengthy haul.