When Canadian-Russian programmer Vitalik Buterin penned a white paper in 2013 outlining a brand new sort of blockchain platform, few may have predicted the seismic affect it might have on the world of finance, know-how, and past.

At the moment (July 30), Ethereum turns 10 years previous, marking a milestone that represents a decade of one of the crucial influential blockchain platforms and a testomony to the rising pains, triumphs, and resilience of the decentralized motion.

How did Ethereum go from a white paper drafted by a 19-year-old to a billion-dollar ecosystem that reshaped world finance?

Learn on to search out out extra.

What’s Ethereum and who invented it?

Co-founder Buterin stated in a 2016 interview that Ethereum was born out of admiration for Bitcoin’s decentralized construction and frustration at its restricted capabilities.

“I believed [those in the Bitcoin community] weren’t approaching the issue in the precise approach. I believed they have been going after particular person purposes; they have been making an attempt to sort of explicitly help every [use case] in a form of Swiss Military knife protocol,” Buterin stated, summarizing his motivation to construct one thing extra adaptable.

From this foundational thought, Ethereum emerged as a decentralized, programmable blockchain — a “world laptop” that will host sensible contracts and decentralized purposes (dApps), chopping out middlemen and enabling new types of coordination.

The muse of the fledgling mission was laid between 2013 and 2014. After releasing his white paper in late 2013, Buterin attracted a handful of co-founders, together with Gavin Wooden, Charles Hoskinson, Joseph Lubin, Anthony Di Iorio, Jeffrey Wilcke, Mihai Alisie, and Amir Chetrit. Collectively, they spearheaded a crowdfunding marketing campaign in mid-2014 that raised over US$18 million, one of many earliest and most profitable Preliminary Coin Choices (ICOs) in crypto historical past.

Regardless of this momentum, the Ethereum blockchain didn’t launch till July 30, 2015. That launch, dubbed “Frontier,” was a primary, uncooked, and developer-focused model of Ethereum designed for constructing the infrastructure that will observe.

ETH, Ethereum’s native coin, initially traded for beneath a greenback. The early months noticed little market motion as ETH hovered between US$0.70 and US$2.00, supported primarily by fans and builders concerned about dApp potential.

When was Ethereum’s first main peak?

Ethereum’s first main value rally got here throughout the 2017 crypto bull run, when rising world curiosity in blockchain know-how and the preliminary coin providing (ICO) growth introduced ETH into the mainstream.

After starting the yr at simply barely US$8, Ethereum surged to a then-record excessive of round US$1,400 by January 2018, capping off one of the crucial explosive value will increase within the historical past of digital property. This greater than 17,000 p.c rise was pushed by a mix of speculative demand and the emergence of Ethereum as the popular platform for launching new tokens by way of ICOs.

By early 2018, nonetheless, the market started to reverse. A sweeping crypto correction noticed Ethereum’s value fall again under US$100 by the top of that yr. The drawdown uncovered Ethereum’s technical bottlenecks, akin to excessive gasoline charges and gradual affirmation occasions throughout community congestion.

What was the DAO Hack, and the way did it affect Ethereum’s trajectory?

Ethereum’s ethos of decentralization was additionally examined early on. In 2016, an experiment in decentralized governance — the Decentralized Autonomous Group or DAO — raised about US$150 million in ETH from the group. The thought was to create a enterprise capital fund ruled totally by sensible contracts and token-holder votes.

However simply weeks after launch, a vulnerability within the DAO’s code that allowed for recursive name exploit was found, draining 3.6 million ETH or a few third of the fund.

At simply ten months previous, Ethereum was now going through a disaster that examined its basic ideas, chief amongst them the immutability of the blockchain and the inviolability of sensible contracts.

Three major responses have been debated. One possibility was to do nothing, honoring the hacker’s actions as reliable beneath the principles of the code and accepting the theft. One other was to implement a “delicate fork” that will blacklist the kid DAO’s tackle, successfully freezing the stolen funds.

Probably the most radical possibility was a “laborious fork” that will roll again the ledger and return all stolen Ether to the unique buyers, which might undo the hack totally.

In the end, the laborious fork went forward, and Ethereum cut up into two chains: the principle Ethereum chain (ETH), the place the funds have been returned to buyers, and a brand new chain referred to as Ethereum Traditional (ETC), which preserved the unique ledger together with the DAO hack.

How has Ethereum carried out post-2020?

Ethereum value efficiency July 30, 2015 – June 30, 2025.

Chart by way of TradingView.

Ethereum reached its all-time excessive value of US$4,878 on November 10, 2021, throughout the peak of the 2020–2021 crypto bull run. The rally was pushed by a convergence of things: institutional adoption of crypto, a large enlargement of decentralized finance (DeFi), and explosive curiosity in NFTs, most of which have been constructed on Ethereum’s ERC-721 commonplace.

By late 2021, Ethereum was settling billions in day by day transaction quantity and powering hundreds of decentralized purposes, cementing its place because the main sensible contract platform.

Nonetheless, the height was short-lived. Inflation fears and world threat aversion in early 2022 triggered a pointy correction throughout threat property, together with crypto. Ethereum’s value dipped under US$1,000 in June 2022 amid cascading liquidations and platform collapses like Terra and Celsius.

Nonetheless, even by means of the drawdown, Ethereum remained the spine of DeFi, NFT markets, and layer-2 innovation, setting the stage for its long-planned transition to proof-of-stake later that yr.

Within the years that adopted the fork, Ethereum confronted rising stress to scale and cut back its environmental affect, significantly as DeFi and NFT exercise surged.

These challenges set the stage for a significant protocol overhaul: Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was thought-about to be one of the crucial formidable technical feats in blockchain historical past. Formally referred to as “the Merge,” the improve mixed Ethereum’s execution layer (the mainnet) with the Beacon Chain, which launched staking-based consensus.

The Merge happened in September 2022 and the environmental affect was speedy: Ethereum’s vitality consumption dropped by over 99 p.c.

Whereas the Merge had little short-term impact on value, it marked an important second for Ethereum’s long-term viability. On the time of the improve, ETH was buying and selling at round US$1,600, which was a pointy decline from its all-time excessive of US$4,891 in November 2021 throughout the peak of the crypto bull market.

That value peak had been pushed by unprecedented community demand as NFTs and decentralized finance exploded in recognition, each largely constructed on Ethereum. By mid-2022, nonetheless, macroeconomic tightening, rising rates of interest, and a collection of high-profile crypto failures, together with the collapse of TerraUSD and the insolvency of main lending platforms, had triggered a broad downturn.

After the Merge, ETH remained risky. It already misplaced floor by as a lot as 70 p.c towards crypto chief Bitcoin for the reason that Merge, and the introduction of EIP-1559 in 2021 had already created a extra deflationary stress on ETH provide by means of base price burns.

Regardless of this setback, ETH confirmed relative resilience in comparison with many altcoins. In 2023, Ethereum hovered principally between US$1,200 and US$2,100, with value actions intently monitoring investor sentiment towards regulatory developments, Bitcoin’s efficiency, and broader market liquidity. Institutional curiosity in Ethereum additionally grew throughout this era, with extra funds launching ETH merchandise and staking providers increasing.

Getting into 2024, Ethereum gained momentum amid bettering macroeconomic situations and renewed optimism about real-world purposes for blockchain know-how. The community noticed reasonable success in sectors like tokenized property, layer-2 infrastructure, and decentralized identification.

ETH briefly reclaimed the US$4,000 degree in early March 2024 earlier than retreating once more attributable to renewed regulatory scrutiny within the US. Regardless of the pullback, Ethereum remained the second-largest cryptoasset by market capitalization and retained the bulk share of developer exercise throughout all chains.

The 2025 Swing

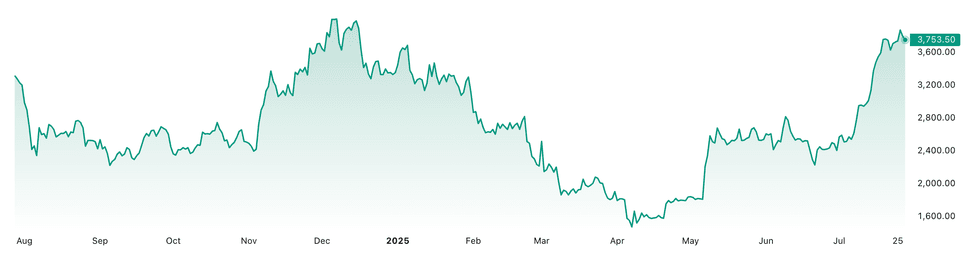

Ethereum 1-year value efficiency, July 28, 2024 – July 28, 2025.

Chart by way of TradingView.

Ethereum, in addition to the remainder of the crypto panorama, noticed a full constructive swing in 2025 as regulatory readability dominated the primary half of the yr.

In June, the US Senate authorised the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act with bipartisan help. President Donald Trump, now serving his second time period, publicly backed the invoice, calling it “a win for American innovation and monetary management.”

The GENIUS Act establishes a regulatory framework for US-pegged stablecoins, requiring full reserve backing, unbiased audits, and federal licensing for big issuers. It additionally clarifies that qualifying stablecoins should not securities, pulling them out of the SEC’s jurisdiction and as a substitute aligning oversight with banking regulators just like the OCC and Federal Reserve.

Crucially, the regulation defines “fee stablecoins” as a brand new class of digital money, and Ethereum has emerged as one of many largest beneficiaries of this coverage shift. Nearly all of dollar-backed stablecoins, which embrace USDC, USDT, and newer entrants like PayPal USD, are issued and transacted on Ethereum.

The GENIUS Act’s authorized recognition of stablecoins has given institutional gamers extra confidence to interact with Ethereum-based infrastructure.

In consequence, capital inflows into Ethereum have accelerated, with analysts noting a pointy uptick in demand for ETH as a “platform asset” powering tokenized {dollars} and digital settlement rails.

ETH’s value additionally quickly adopted. Following the Senate’s approval of the GENIUS Act in June 2025, ETH jumped over 25 p.c in two weeks, briefly reaching US$3,824 — outperforming Bitcoin and breaking out of a multi-month consolidation vary.

The act has additionally prompted strategic shifts amongst monetary establishments. BlackRock, Constancy, and JPMorgan have expanded their Ethereum-based choices, together with on-chain fund administration, tokenized treasuries, and collateralized lending protocols that depend on sensible contracts.

A number of US banks are additionally piloting inside fee rails utilizing tokenized {dollars} on Ethereum rollups.

What’s subsequent for Ethereum?

Buterin himself has acknowledged that Ethereum’s present roadmap will not be the top. Talking in late 2022 earlier than the Merge, he famous that “Ethereum is 55 p.c full.”

The long-term imaginative and prescient contains higher privateness options, zero-knowledge proofs for safe scalability, and increasing the attain of dApps to a billion customers.

As of mid-2025, Ethereum at present trades round US$3,400, buoyed by sturdy institutional adoption, continued progress of layer-2 networks like Arbitrum and Base, and early indicators of real-world asset tokenization gaining traction amongst banks and fintech companies.

Whereas Ethereum’s value stays properly under its 2021 peak, its efficiency since 2020 displays rising maturity, with fewer speculative surges and extra curiosity anchored in a extra crypto-friendly atmosphere.

Do not forget to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Giann Liguid, maintain no direct funding curiosity in any firm talked about on this article.