In This Article

Over the previous 12 months, the hole between the variety of lively sellers and lively consumers has widened to its largest margin because the wake of the Nice Recession. In response to Redfin, as of April 2025, sellers outnumbered consumers practically 4 to three, with a full 500,000 extra promoting their properties than seeking to purchase one.

This doesn’t imply that one other actual estate-driven monetary disaster is approaching (largely as a result of stronger debtors with low-interest, fastened loans, in contrast to the subprime teaser charges of pre-2008). However it does clearly point out that the actual property market is softening. And this comes at an inopportune time, as a silent disaster has been eroding the money circulation of actual property buyers for a number of years now: the working price disaster.

Whereas I not often see it mentioned overtly, each investor I’ve talked to just lately has felt the squeeze that working prices have placed on our companies. Simply check out how a lot varied working prices have gone up in 2024:

Property taxes nationwide went up a mean of 5.1%

House insurance coverage went up a mean of 10.4%

In the meantime, wages went up 4.2% as of March

All these are considerably larger than the present inflation price.

Some value progress has truly moderated, however solely after monumental will increase previously few years. For instance, development materials costs solely went up solely 1.3% in 2024, however that’s after will increase in 2021 and 2022 of 14.6% and 15%, respectively. Gasoline costs have truly come down for 2 straight years, however are nonetheless over 50% larger than they have been in 2021. Electrical energy charges solely elevated 0.9%, however that was after a 12.1% surge in 2022.

Moreover, with the latest federally mandated change from utilizing R-410A to R-454B AC models, HVAC costs are prone to rise dramatically.

In the meantime, asking rents solely elevated 0.4% 12 months over 12 months as of February.

And this might get even worse with the potential fallout of the brand new tariffs or additional instability within the Center East.

All that is occurring in a market the place dwelling costs are nonetheless, not less than nominally, larger than they’ve ever been, and rates of interest are as excessive as they’ve been because the late ‘90s. And refinancing is often cost-prohibitive.

Many have concluded that the BRRRR technique merely doesn’t work proper now, and I are likely to agree. However we and plenty of others nonetheless have a number of leases, and it’s getting more durable and more durable to maintain them money flowing.

So let’s dive into a number of the finest methods to make sure they do hold money flowing, even on this very difficult surroundings. We’ll begin by taking a look at methods to chop working prices.

First up is debt service.

Reamortizing Loans as They Renew at Greater Charges

When rates of interest shot up in mid-2022, there have been many doomsayers who thought the market was going to break down. This thought was based mostly on a basic misunderstanding of the state of affairs, given the low-interest, fastened loans that each house owner had put no downward strain on costs.

Sadly, most buyers don’t have 30-year fastened mortgages. They are often fastened for 5 years. So when these renewals hit, your rate of interest, and thereby your mortgage cost, spike. This was a giant consider the multifamily recession in 2023 and 2024.

Nowadays, every time considered one of our loans is up for renewal, we ask to reamortize or recast the mortgage. Briefly, we reset the amortization in the beginning as if we have been refinancing it.

Given the principal has been paid down and costs have gone up, our banks have been prepared to do that with out a new appraisal or refinance charges. On one portfolio mortgage, for instance, our rate of interest reset from 4.25% to eight%! But as a result of we reamortized it, our cost truly went down.

It might work one thing like this. Say you had a $1 million mortgage at 4% curiosity, amortized over 25 years. The cost could be $5,278/month. If it renewed at 6.75% (the place charges are as of this writing), the cost would bounce to $6,909/month. That’s virtually $1,700 extra, which is the distinction between being within the black and crimson for a lot of.

Nevertheless, after 5 years on the first renewal, the principal would have been paid all the way down to $871,046. After 10 years, on the second renewal, it might be all the way down to $713,594.

Regardless of the mortgage being at $871,046, your funds are nonetheless based mostly on the unique $1 million principal. By reamortizing the mortgage, your funds are based mostly on a mortgage of $871,046. So it might appear like this:

Unique principal: $1 million

Unique cost (4%): $5,278/month

New cost (6.75%): $6,909/month

Then:

First renewal principal (6.75%): $871,046

First renewal cost (6.75%): $6,018/month

Then:

Second renewal principal (6.75%): $713,594

Second renewal cost (6.75%): $4,930/month

Sure, you’ll repay much less principal, however in a market the place money circulation is an increasing number of troublesome to return by, that’s actually a secondary concern. Even after simply 5 years, the elevated cost after reamortization is lower than half what it might have been. On the 10-year mark, the cost could be much less, regardless of the rate of interest going up virtually three share factors.

Of the six completely different banks we work with, just one has mentioned no. And that was on a small mortgage that we originated with one other financial institution that was purchased out. Whereas giant nationwide banks might not be prepared to do that, most native banks will. It’s positively price asking.

Promoting Money Stream Losers

Whereas the market has develop into extra of a purchaser’s market, it has in no way shut down. So it might nonetheless be price trying via your portfolio to see if there are any properties that not make sense to carry. We did this after rates of interest went up, after which after property taxes have been jacked via the roof in 2023 in Jackson County, MO, the place most of our properties are.

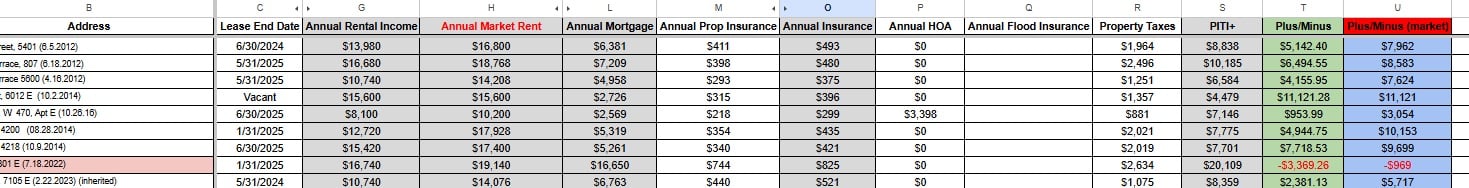

We got here up with a manner of measuring the fastened prices related to the property after which a ballpark of their variable prices, and then in contrast that to present and market lease.

The fastened prices included:

Mortgage funds

Property taxes

Property insurance coverage

Flood insurance coverage, if any

HOA charges, if any

Variable prices included upkeep, turnover, and emptiness. (We handle ourselves, so didn’t embrace that within the equation).

The sheet seems like this, with conditional formatting used to focus on any property that got here out adverse in crimson:

The sheet goes on to make estimates for upkeep, turnover, and emptiness prices based mostly on the age and dimension of the property. However simply right here, you may see one property was adverse with out even together with these prices.

This rental was harm by the tax enhance and an HOA price enhance in the identical 12 months. By far, we discovered those that don’t money circulation are giant homes (notably older ones) and condos (due to the HOA price). So one after the other, we’ve been placing these on the chopping block.

We additionally determined to promote properties that have been over a 30-minute drive from our workplace, as they burdened our property administration sources, in addition to homes that also had a personal mortgage on them (as we didn’t have an opportunity to achieve the refinance stage of the BRRRR methodology earlier than rates of interest elevated).

Whatever the actual standards you utilize, it might be price attempting to rightsize your portfolio for money circulation, in case you haven’t completed it already.

You may also like

Difficult Tax Will increase and Rebidding Insurance coverage

As famous, property taxes went loopy in Jackson County in 2023. Ours went up a mean of 67%! Nevertheless, after difficult them, I acquired them all the way down to a still-crazy-but-more-reasonable 39%. These financial savings are extremely vital.

Even throughout regular years, it’s price going via your tax assessments fastidiously and difficult any that appear excessive.

You also needs to not assume you’re getting the very best value for property insurance coverage accessible. I heard quite a few horror tales of property insurance coverage going via the roof final 12 months (together with on my private residence), however our firm’s costs didn’t budge. This was as a result of our insurance coverage dealer was in a position to create a Frankenstein’s monster of a coverage by slicing and dicing our portfolio amongst 5 completely different insurers.

For sure, he constructed a number of loyalty with us.

At a minimal, it’s price purchasing your portfolio yearly or two. That’s how we discovered our present dealer. We requested for quotes from 4 or 5 insurance coverage firms and ended up saving one thing like 20%. These sorts of financial savings may be important.

Run a Value Audit

Yearly, we run a companywide price audit to search out issues we shouldn’t be paying for or are paying an excessive amount of for. Two years in the past, we discovered that we have been paying TextMyBiz one thing like $30/month for a service we by no means used. OK, that’s not rather a lot, however we have been paying for no purpose, and such issues can add up.

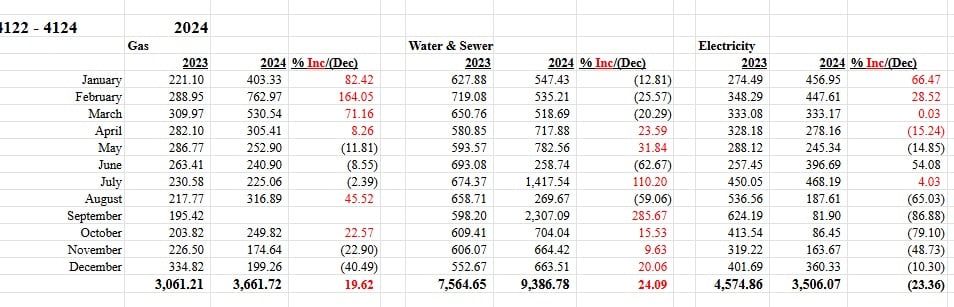

We additionally seemed intently in any respect the properties we pay the utilities on and located a number of with water payments that have been manner too excessive. We acquired these leaks addressed promptly. So we now monitor all of their utility bills towards earlier years to search for discrepancies.

Keep in mind, it’s vital to search for each stuff you shouldn’t be paying for and issues you’re paying an excessive amount of for. It’s additionally price creating budgets and KPIs so you may observe and curtail bills.

Please observe, nevertheless, there are some prices you need to by no means minimize. Like tenant screening—by no means minimize that!

Using Expertise to Cut back Bills

There are numerous technological options that can be used to cut back prices. ShowMojo or Rently are less expensive than leasing brokers. AI or Fiverr can be used for graphic design and to create logos, in addition to assist with writing property descriptions, employment adverts, and many others. AI Chatbots can reply easy questions for prospects. DocuSign can scale back the prices of workplace provides. Good thermostats or leak detectors can scale back utility prices, notably on bigger and industrial models that you simply pay the utilities for. In harmful areas, the price of safety gear, like SimpliSafe, has fallen dramatically in recent times.

And in case your properties are unfold out, an electrical automobile can save on fuel.

It might positively be price spending a while brainstorming how expertise can minimize quite a lot of working prices throughout the board.

Hiring As an alternative of Paying Contractors

This would solely make sense for these with a pretty giant portfolio. However broadly talking, in case you rent good development guys and handle them effectively, they are going to be inexpensive than contractors.

That being mentioned, that’s a number of ifs. And we’ve been on the incorrect aspect of that equation earlier than.

If nothing else, we’ve been in a position to prolong the lifetime of our HVAC and cease damages from accumulating with preventative upkeep inspections. You want to belief tenants to interchange their furnace filters and name upkeep when there are leaks. However sadly, that’s most frequently not the case. Doing it your self ensures these methods are protected and issues that would trigger main harm get nipped within the bud.

Reductions and Standardization

One other factor to think about is attempting to purchase all of the supplies in your contractors your self. The extra you purchase, the extra reductions you get from locations like House Depot via their Professional Xtra program. As well as, you need to be part of your native Actual Property Buyers Affiliation, as they’ve a two p.c low cost with House Depot for REIA members. And naturally, BiggerPockets Professional members get related advantages.

Moreover, it’s vital to standardize right here as a lot as doable. Use the identical few paint colours and flooring so it’s simpler to match. And look into shopping for in bulk when doable for added financial savings.

Take Benefit of Actual Tax Advantages

There are a number of tax benefits for long-term actual property buyers: depreciation, price segregation, carried ahead loss, 1031 exchanges, stepped up foundation, and many others.

Be sure you and your accountant are making the most of all of those to maintain your earnings taxes low or nonexistent.

Managing Your self

There are prices and advantages to managing properties your self. However in case you don’t have an enormous portfolio, have ample time, and are using near the road or (extra seemingly) your property supervisor isn’t doing job, this could possibly be possibility.

Your typical property supervisor expenses 10 p.c of collected rents, all late charges, and the primary month’s lease for brand spanking new tenants. Your time isn’t free, so don’t suppose you’re saving all that by managing your self. However, the money financial savings might very effectively make up for the time and power prices in some conditions.

Rising Earnings

Rising earnings is simply pretty much as good a option to remedy an working prices disaster as slicing prices, so let’s take a look at just a few concepts there, too.

Hold Elevating Rents

This appears like a no brainer, however it’s vital to maintain elevating rents as prices go up. That is notably true when you have excessive occupancy. In actual fact, the upper the occupancy, the extra aggressive you need to are usually on lease will increase. (Having an occupancy that’s “too excessive,” i.e., over 95 p.c, is an indication your rents are too low in actual fact).

It’s additionally price taking a look at any under-rented properties you’ll have, particularly people who to procure with inherited residents who’ve lower-than-market rents however want work. I completely hate doing this, however it’s most likely time to think about asking them to depart to truly repair up the property and lease it for what it’s price.

STR, MTR, and Hire by the Room

Quick-term leases have develop into an enormous trade within the final 10years. Airbnb is valued at $85 billion, for instance. In sure circumstances, it makes absolute sense to modify properties you will have over to STR, particularly if they’re in city facilities or trip spots.

Medium-term leases are additionally changing into an increasing number of widespread and one thing to think about in sure conditions. That being mentioned, it’s essential be careful for 2 issues with these:

The prices to furnish them may be important.

Native rules have gotten an increasing number of strict, so verify your native legal guidelines fastidiously.

And allow us to not overlook that switching properties to pupil leases close to faculties may also be very profitable. In actual fact, it’s how my father acquired began in actual property.

Lastly, in a time when affordability is a big concern for individuals, renting out by the room has develop into an increasing number of widespread and may enhance the lease a property can get on the entire. Corporations like PadSplit may also help automate this course of.

Cost for Facilities

If you don’t cost pet lease and a nonrefundable pet deposit, you have to. On the identical time, make sure that to cost and truly implement late charges. If a upkeep concern was brought on by a tenant, have a thick pores and skin and cost them again for it.

As well as, there could also be different sources of earnings you may attempt to get. We’ve got performed round with providing garden mowing providers, rental washers and dryers, and the like. Thus far, we haven’t had a ton of success there, however now we have gotten just a few takers and marginally elevated our earnings. And each little bit counts.

Complement Rental Earnings With Different Endeavors

For buyers, focusing extra on flipping or wholesaling proper now to complement money circulation is under no circumstances a foul concept. The identical goes for individuals who are actual property brokers or contractors.

In actual fact, that is considered one of our predominant methods proper now. We began our personal development and HVAC firm for third-party shoppers within the Kansas Metropolis space, as we don’t have as a lot work to do in-house as we used to. We suppose we constructed a nice system for scoping tasks and overseeing rehab, and may cost much less for HVAC, given our infrastructure is already in place, so this appeared like a pure option to develop our enterprise and handle our best want: money circulation.

A buddy of mine, then again, opened up an actual property brokerage, a mastermind group, and a DSCR lending firm. One other does exhausting cash loans.

Does it make sense to concentrate on different areas or develop your online business in a brand new route? These are questions you ought to be asking.

Bonus: Householders

I’ll end off with one final tip for owners who want to maneuver. This may be very tough, provided that the identical amount of cash with a pre-2023 mortgage will purchase a a lot greater and higher home than a post-2023 mortgage, as a result of how a lot rates of interest have gone up since then.

My greatest advice for individuals who want to maneuver however are sitting on 2%, 3%, and 4% mortgages is to carry on to these mortgages along with your life! That type of debt is simply too worthwhile. As an alternative of promoting your present dwelling and shopping for one elsewhere, lease the one you personal, and in case you can’t purchase elsewhere below these circumstances, simply lease.

It might appear odd to lease a home if you personal a rental, however who cares if it’s odd? It makes far more monetary sense than promoting a home with a 3 p.c mortgage simply to purchase a smaller one in a worse space with a 7% mortgage.

Analyze Offers in Seconds

No extra spreadsheets. BiggerDeals exhibits you nationwide listings with built-in money circulation, cap price, and return metrics—so you may spot offers that pencil out in seconds.