Supply: The Faculty Investor

This Halloween’s most terrifying tales have extra to do along with your cash than goblins and zombies.

In gentle of this spooky season, we’re sharing some scary monetary statistics and information about cash that might occur to you. However no have to run screaming, we offer you just a few suggestions that can assist you should you’re ever caught in any of those conditions.

1. The Authorities Can Garnish Your Social Safety Checks For Unpaid Scholar Loans

Most Federal scholar mortgage compensation plans result in mortgage cancellation after 20 or 25 years. Which means most scholar mortgage debtors won’t have the chains of scholar debt going into retirement.

Nevertheless, mother and father who wish to assist their youngsters via faculty could signal Direct PLUS or Mum or dad PLUS loans. These types of further debt are debt in mum or dad’s names, and may simply comply with the borrower into retirement. If you happen to default in your PLUS loans, the federal government can garnish as much as 15% of your Social Safety Advantages to offset the funds.

Fortunately, it’s doable to rehabilitate Mum or dad PLUS loans and even get onto sure types of Revenue Contingent Reimbursement Plans. These may be essential to retaining extra of your Social Safety Test in your dwelling bills.

2. Inflation Is Rising Quicker Than Wages

Whether or not you’re on the grocery retailer or the gasoline pump, you already know that costs are rising throughout the board. What pundits referred to as “transitory” inflation a number of years in the past has caught round, and now we’re feeling it all over the place.

Sadly, the excessive charge of inflation signifies that most individuals have much less spending energy. Wages are rising, however not as quick as inflation. In response to the Bureau of Labor Statistics, the actual worth of wages and salaries elevated simply 0.9% for the 12 months ending June 2024.

The decline in spending energy is having actual results throughout the financial system. Whereas high-income employees can climate the climbing costs via a little bit of belt-tightening, these with decrease wages spend an enormous proportion of their revenue on wants fairly than desires.

Determining methods to fulfill wants and keep out of debt is changing into harder. Actually, the Federal Reserve Financial institution of New York not too long ago famous, “The…cumulative improve in bank card balances…represents the most important in additional than 20 years.”

If you happen to’re at present staring down giant bank card balances, these kind of debt aid could assist.

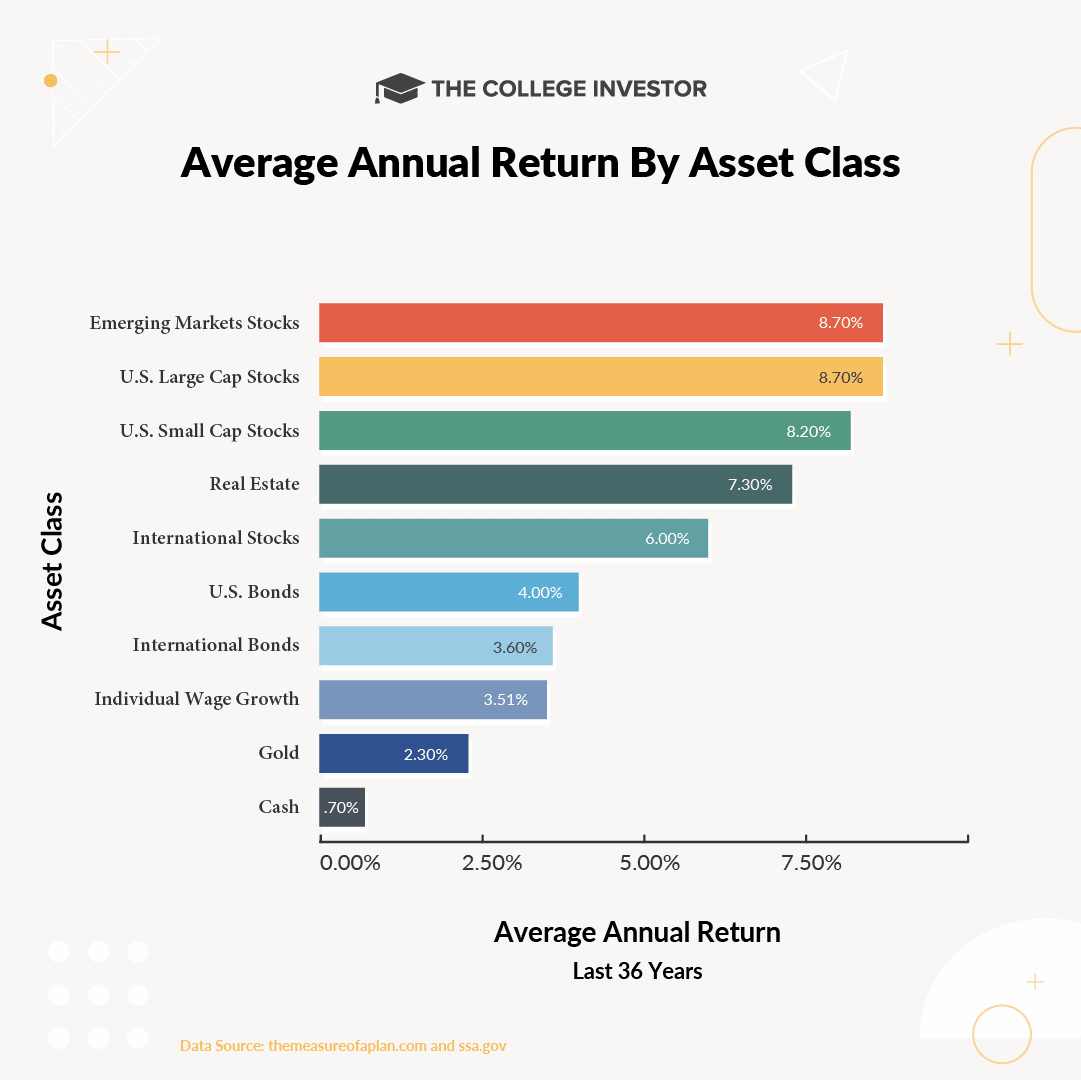

Keep in mind, even in good occasions, particular person wage progress solely averages about 3.51% per 12 months. That also lags most investments:

3. Practically A Quarter of Adults Have Nothing Saved For Retirement

In response to the Planning & Progress Research by Northwestern Mutual, 22% of all adults have lower than $5,000 saved for retirement. Whereas scholar loans and stagnating wages account for a few of the low financial savings charges, one other issue is that many individuals rely an excessive amount of on their future willpower.

It’s all the time troublesome to stay with long-term financial savings objectives, however you’ll be able to automate your financial savings utilizing an app or by contributing to your office retirement plan. Saving $100 to $200 per 30 days may help you get your retirement financial savings on observe.

4. Banks Collected Extra Than $15 Billion In Bogus Charges

Banks collected greater than $15.5 billion in these overdraft and Non-Ample Fund (NSF) charges, in keeping with this examine. These huge charges account for an awesome majority of all banking charges collected by banks (who, by the way in which, additionally earn a living on the deposits in accounts). For instance, banks solely collected $4 billion in upkeep charges and fewer than $1.5 billion in ATM charges.

Trendy banking locations an enormous monetary burden on the individuals who can least afford it. If you happen to’re somebody who lives paycheck to paycheck, it’s essential to discover a financial institution that gained’t cost you $35 everytime you run out of money.

For fee-free banking, we advocate Chime which provides paycheck advances, Varo which provides low-cost money advances, or Present which has no month-to-month prices and provides a strong curiosity in your stability.

5. A $400 Emergency Will Ship Extra Than A Third Of Individuals Scrambling

Whereas 64% of adults can simply deal with a $400 emergency, greater than a 3rd of Individuals don’t have sufficient financial savings to cowl this expense, in keeping with the Financial Nicely-Being of U.S. Households, a report launched by The Board of Governors of the Federal Reserve.

To cowl the expense, 15% would put the expense on a bank card, and 9% would borrow from household or mates. Amongst these surveyed, 12% mentioned they might not cowl the expense in any respect, even with debt.

Able to construct your emergency fund? See our information to Emergency Funds right here.

Are You A Half Of These Chilling Statistics?

Loads of folks fall into troublesome monetary conditions via no fault of their very own. Many hardworking folks get caught dwelling examine to examine or slipping into debt for requirements.

In some circumstances, the important thing to avoiding these issues is incomes extra money. Negotiating a elevate, discovering a higher-paying discipline, or incomes promotions have a tendency to assist improve your revenue. Aspect hustles (particularly people who require a excessive talent degree) can enhance your earnings too.

30 Passive Revenue Concepts To Construct Wealth

You possibly can’t earn residual revenue with out an upfront financial funding, or an upfront time funding.

Passive revenue is just not your job, freelancing, or working on-line.

Passive revenue is doing one thing as soon as, then incomes rewards from it into the long run.

Try 30 passive revenue concepts to start out constructing your wealth.

It is essential to place the additional dough to work by investing or paying off debt shortly so that you don’t must dwell the horror of those unnerving cash statistics.