by Mike Maharrey

After working the third-largest funds deficit in historical past in fiscal 2024, the Biden administration kicked off fiscal 2025 in an analogous method.

The federal authorities ran a $257.45 billion funds shortfall to start out the brand new fiscal yr, with income down and spending up, in accordance with the newest assertion from the Division of Treasury.

That was a 287 % enhance over the October 2023 deficit.

Federal receipts got here in at $326.77 billion. That was down about 19 % in comparison with October 2023. A one-time inflow of tax funds deferred on account of wildfires final yr boosted October 2023 revenues.

As has been the case for months, the massive drawback is on the spending facet of the ledger.

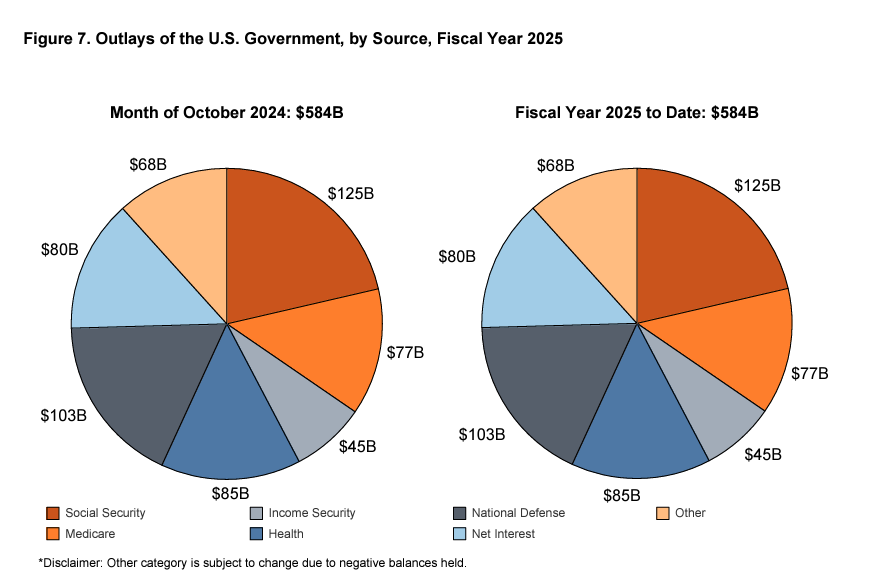

The Biden administration blew by means of $584.22 billion final month. That was a 24 % year-on-year enhance. Outlays for Social Safety, Medicare, and nationwide protection all elevated.

You may recall that President Biden promised that the [pretend] spending cuts would save “lots of of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Duty Act).

That by no means occurred.

The federal authorities continues to seek out new causes to spend cash, whether or not for pure disasters at house or wars abroad. The Biden administration spent a staggering $6.75 trillion in fiscal 2024, a ten % enhance over 2023 outlays.

The federal authorities spent $82 billion on curiosity bills final month. That was a modest 8 % decline, the primary annual drop in curiosity expense since August 2023. The Treasury Division stated the decline was pushed by a $12 billion discount in payouts for inflation-protected securities due to a decrease CPI.

Internet curiosity expense got here in at $80 billion. That was a $4 billion enhance over October 2023.

Uncle Sam paid $1.13 trillion in curiosity expense in fiscal 2023. It was the primary time curiosity expense has ever eclipsed $1 trillion.

Curiosity funds have been up 28.6 % over fiscal 2023 ranges.

Don’t let the small decline in curiosity expense final month idiot you. The overall pattern stays upward. Even with the current Federal Reserve price cuts, Treasury yields are pushing upward as demand for U.S. debt sags. Since Trump’s electoral victory, the yield on the 10-year Treasury is up 15 foundation factors.

A lot of the debt presently on the books was financed at very low charges earlier than the Federal Reserve began its climbing cycle. Each month, a few of that super-low-yielding paper matures and needs to be changed by bonds yielding a lot larger charges.

Affect of the Debt

We see these huge deficits month after month, however most individuals don’t bat a watch. There appears to be a way that spending greater than you absorb month after month isn’t actually an issue.

However anyone who says “deficits don’t matter” is deluded.

Because the Bipartisan Coverage Middle factors out, the rising nationwide debt and the mounting fiscal irresponsibility undermine the greenback.

“Confidence in U.S. creditworthiness could also be undermined by a quickly deteriorating fiscal state of affairs, an growing concern with federal debt set to develop considerably within the coming years.”

This might result in decrease financial progress, larger unemployment, and fewer funding wealth.

Insecurity within the U.S. fiscal state of affairs may additionally decrease demand for U.S. debt. This is able to power rates of interest on U.S. Treasuries even larger to draw traders, exacerbating the curiosity fee drawback.

The nationwide debt continues to spiral upward at a dizzying tempo. It’s going to formally prime $36 trillion inside days. In response to the nationwide debt clock, that represents 122.85 % of GDP. Research have proven a debt-to-GDP ratio of over 90 % retards financial progress by about 30 %.

The debt will probably be one of many greatest issues going through President Trump as he takes the reins of energy. With Republicans controlling each chambers of Congress and the White Home, there is a chance to deal with the spending drawback, however whether or not the GOP has the political will to make substantial cuts stays to be seen.