Grande Portage has assembled a drill core composite which is reflective of the anticipated manufacturing from the Conceptual Mine Plan. The composite consists of each ore and waste samples to replicate the anticipated dilution from wall rock (waste) which is inherent with underground blasting of slim ore veins. This core is being subjected to a sensor-based ore sorting check course of on the services of Steinert US Inc, a number one world producer of ore-sorting tools. The aim of ore sorting is to rapidly separate particles of waste dilution rock from the mined materials, with out the usage of chemical reagents.

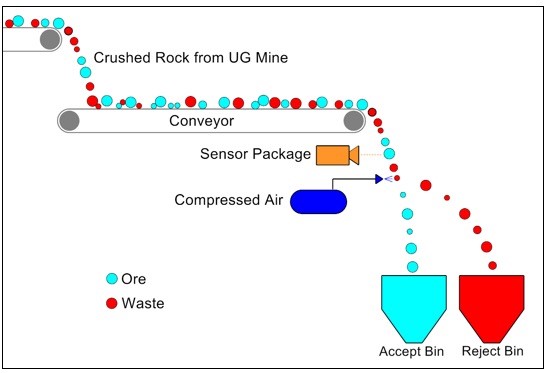

Sensor-based ore sorting makes use of a wide range of measurements to find out whether or not a particle is ore or waste, together with coloration, electromagnetic induction, and x-ray evaluation to evaluate elemental composition. The crushed rock is positioned on a conveyor belt after which dropped in entrance of the sensor, which quickly analyzes the person items of rock. When a chunk of rock is recognized as waste, a puff of compressed air redirects it to a “reject” bin. The remaining items of rock are despatched to the stockpile of accepted materials. (Fig. 2)

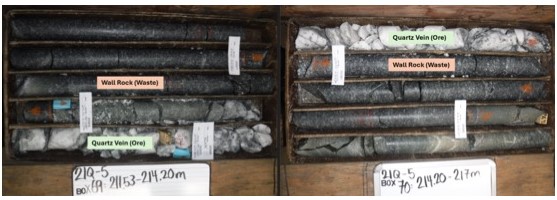

The New Amalga deposit is taken into account an excellent candidate to be used of ore sorting expertise for the reason that wall rock is usually each visually and geochemically distinct from the quartz vein useful resource (Fig. 3).

Ian Klassen, President and CEO feedback: “Sensor-based ore sorting is a well-established expertise at present in use at many mines worldwide, and we’re very excited to be working with Steinert to check its effectiveness on samples consultant of the New Amalga conceptual mine plan.”

Mr. Klassen continued: “Integrating ore sorting into the manufacturing plan might considerably cut back the quantity of mined rock requiring transportation and processing at a third-party facility, decreasing per-ounce prices whereas additionally offering helpful sorter-reject materials for underground backfill as a part of the mining cycle. This may additional improve the present benefits of our proposed direct-ship mine configuration which makes use of offsite processing. It could additionally create alternatives for inclusion of thinner veins into the mine plan – areas of the deposit which in any other case might not have been thought-about viable.”

Fig. 1: Location of New Amalga Mine Undertaking

Fig. 2: Simplified Conceptual Diagram of an Ore Sorting System

Fig. 3: Instance of New Amalga Drill Core, Displaying Distinct Wall Rock vs Quartz Vein Intervals

The Firm can also be happy to announce that it has entered into an promoting/e-marketing contract with 1000903966 Ontario Inc. to supply advertising companies, together with social media engagement by way of X (previously Twitter), Fb, YouTube and Reddit. The preliminary time period of the settlement is 90 days, beginning on January 6, 2025, and could also be renewed with mutual written settlement. In the course of the preliminary time period, 1000903966 Ontario Inc., will likely be paid CAD$12,000.

Kyle Mehalek, P.E.., is the QP inside the which means of NI 43-101 and has reviewed and authorised the technical disclosure on this launch. Mr. Mehalek is unbiased of Grande Portage inside the which means of NI 43-101.

About Grande Portage:Grande Portage Assets Ltd. is a publicly traded mineral exploration firm centered on the New Amalga Gold Mine Undertaking (previously the Herbert Gold undertaking) located roughly 25 km north of Juneau, Alaska. The Firm holds a 100% curiosity within the New Amalga property. The New Amalga Gold property system is open to size and depth and is host to a minimum of six predominant composite vein-fault buildings that comprise ribbon construction quartz-sulfide veins. The undertaking lies prominently inside the 160km lengthy Juneau Gold Belt, which has produced over seven million ounces of gold.

The Firm’s up to date NI#43-101 Mineral Useful resource estimate (filed in June 2024) reported at a base case mineral assets cut-off grade of two.5 grams per tonne gold (g/t Au) and consists of: an Indicated Useful resource of 1,438,500 ounces of gold at a mean grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Useful resource of 515,700 ounces of gold at a mean grade of 8.85 g/t Au (1,813,000 tonnes), in addition to an Indicated Useful resource of 891,600 ounces of silver at a mean grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Useful resource of 390,600 ounces of silver at a mean grade of seven.33 g/t silver (1,813,000 tonnes).

ON BEHALF OF THE BOARD

“Ian Klassen”Ian M. KlassenPresident & Chief Govt OfficerTel: (604) 899-0106Email: Ian@grandeportage.com

Cautionary Assertion Concerning Ahead-Wanting InformationThis information launch consists of sure “forward-looking statements” below relevant Canadian securities laws. Ahead-looking statements embody estimates and statements that describe the Firm’s future plans, goals or objectives, together with phrases to the impact that the Firm or administration expects a acknowledged situation or end result to happen. Ahead-looking statements could also be recognized by such phrases as “believes”, “anticipates”, “expects”, “estimates”, “might”, “might”, “would”, “will”, or “plan”. Since forward-looking statements are based mostly on assumptions and tackle future occasions and circumstances, by their very nature they contain inherent dangers and uncertainties as described within the Firm’s filings with Canadian securities regulators. There will be no assurance that such statements will show to be correct, as precise outcomes and future occasions might differ materially from these anticipated in such statements. Accordingly, readers mustn’t place undue reliance on forward-looking statements. The Firm disclaims any intention or obligation to replace or revise any forward-looking data, whether or not on account of new data, future occasions or in any other case, aside from as required by legislation.

Please word that below Nationwide Instrument 43-101, the Firm is required to reveal that it has not based mostly any manufacturing resolution on NI 43-101-compliant reserve estimates, preliminary financial assessments, or feasibility research, and traditionally manufacturing selections made with out such reviews have elevated uncertainty and better technical and financial dangers of failure. These dangers embody, amongst others, areas which can be analyzed in additional element in a feasibility examine or preliminary financial evaluation, corresponding to the applying of financial evaluation to mineral assets, extra detailed metallurgical and different specialised research in areas corresponding to mining and restoration strategies, market evaluation, and environmental, social, and neighborhood impacts. Any resolution to put the New Amalga Mine into operation at ranges meant by administration, broaden a mine, make different production-related selections, or in any other case perform mining and processing operations can be largely based mostly on inside personal Firm knowledge, and on reviews based mostly on exploration and mining work by the Firm and by geologists and engineers engaged by the Firm.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

SOURCE:Grande Portage Assets Restricted

View the unique press launch on accesswire.com